Gujarat Gaun Seva Pasandgi Mandal has published an Advertisement for the Accountant and Sub Accountant (GSSSB Recruitment 2024). Eligible Candidates are advised to refer to the official advertisement and apply for this Accountant and Sub Accountant. You can find other details like age limit, educational qualification, selection process, application fee, and how to apply are given below for GSSSB Accountant and Sub Accountant Recruitment. Keep checking Maru Gujarat regularly to get the latest updates for GSSSB Recruitment 2024.

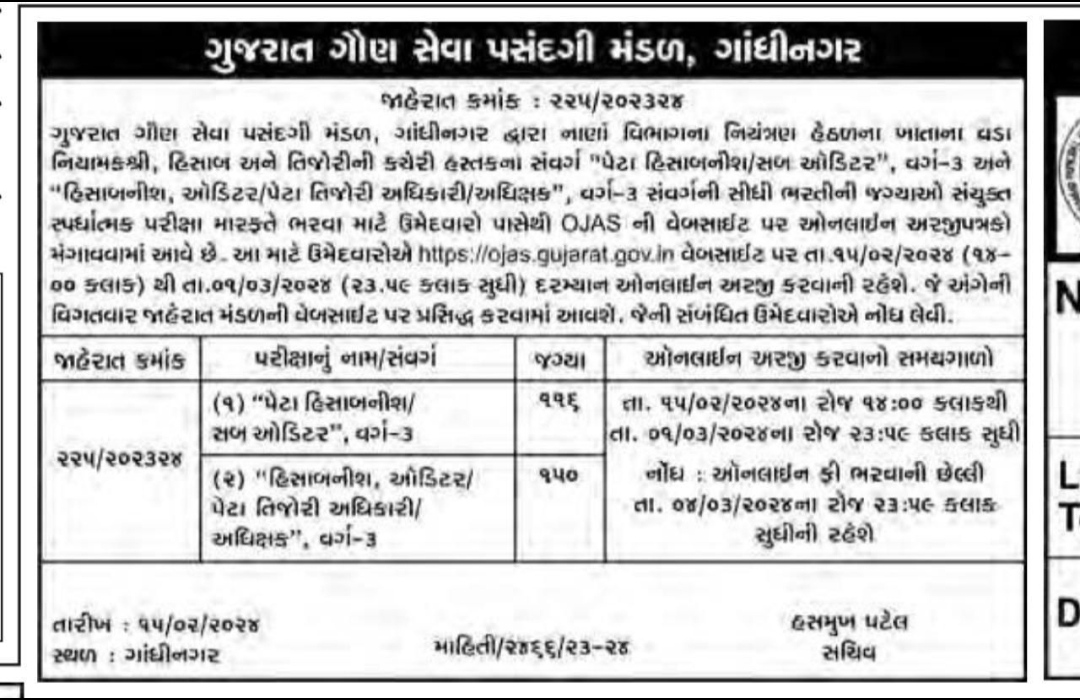

GSSSB Recruitment 2024: The Gujarat Gaun Seva Pasandgi Mandal has come up with 266 vacancies for GSSSB Accountant and Sub Accountant posts. The officials have announced that young aspirants with consistent academic records can apply online for GSSSB Accountant and Sub Accountant Recruitment 2024. The online registration window has been started from 15-02-2024, 02:00 pm onwards at the official website. For more details regarding the GSSSB Accountant and Sub Accountant Recruitment drive and a direct link to apply online for GSSSB Accountant and Sub Accountant Recruitment go through the below article.

GSSSB Recruitment 2024 – GSSSB Recruitment 2024

| Recruitment Organization | Gujarat Gaun Seva Pasandgi Mandal (GSSSB) |

| Posts Name | Accountant and Sub Accountant |

| Vacancies | 266 |

| Job Location | India |

| Last Date to Apply | 01-03-2024, 11:59 pm |

| Mode of Apply | Online |

| Category | GSSSB Recruitment 2024 |

| Join Whatsapp Group | WhatsApp Group |

GSSSB Recruitment 2024 Job Details:

Posts:

- Sub Accountant/ Sub Auditor, Class-III: 116 Posts

- Accountant, Auditor/ Sub-Treasury Officer/ Superintendent, Class-III: 150 Posts

Total No. of Posts:

- 266

GSSSB Recruitment 2024 – Educational Qualification:

- A degree in Bachelor of Business Administration or Bachelor of Computer Application or Bachelor of Commerce or Bachelor of Science (Mathematics/Statistics) or Bachelor of Arts (Statistics/Economics/Mathematics) obtained from any of the Universities or institutions established or incorporated by or under the Central or a State Legislature in India or any other educational institution recognized as such or declared to be deemed as a University under section 3 of the University Grants Commission Act, 1956; or possess an equivalent qualification recognized as such by the Government.

- Provided that a candidate who has appeared at a degree examination, the passing of which would render him educationally qualified for the Preliminary Examination, but the result of such examination is not declared, till the last date of filling of the application form as also the candidates who intend to appear at such qualifying examination shall be eligible for admission to the Preliminary examinations

- B.Sc. (CA & IT) તથા M.Sc. (CA & IT) ના ડીગ્રી ધારક ઉમેદવારોને આ જગ્યા માટે લાયક ગણવા માં આવેલ નથી.

- ગુજરાત મુલ્કી સેવા વર્ગીકરણ અને ભરતી (સામાન્ય) નિયમો, ૧૯૬૭માં ઠરાવ્યા પ્રમાણેની કોમ્પ્યુટરના ઉપયોગ અંગેની પાયાની જાણકારી ધરાવતો હોવો જોઇશે.

- ઉમેદવાર ગુજરાતી અને હિન્દી બંને ભાષાનું પૂરતું જ્ઞાન ધરાવતો હોવો જોઇશે.

- Please read the Official Notification for Educational Qualification details.

GSSSB Recruitment 2024 – Age Limit:

- Age Limit: 20 years to 35 years

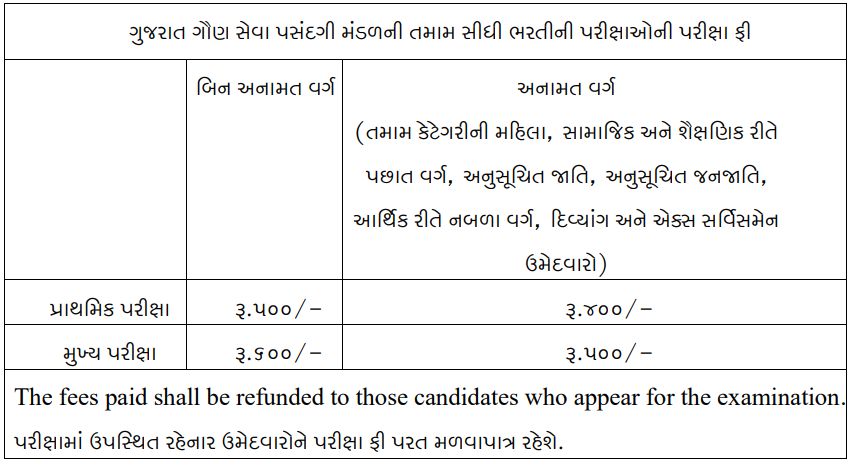

GSSSB Recruitment 2024 – Application Fees:

GSSSB Recruitment 2024 – Scheme of Exam:

Preliminary Exam:

The Preliminary Examination shall consist of one Paper of a total of 150 Marks as follows:

| Paper | Nature of Exam | Subject | Marks | Duration |

| 1. | Objective (MCQs) | General Studies As per Appendix – -A | 150 | 2 Hours |

1. The objective-type Elimination Test shall consist of Multiple-choice Choice Questions (MCQs)

2. Every question shall be of 1 mark.

3. Every attempted question with an incorrect answer shall carry a negative mark of 0.25

Main Exam:

The scheme and subjects of the Main Examination shall consist Total Marks of the following papers:

| Paper | Nature of Exam | Subject | Marks | Duration |

| 1 | Descriptive | Gujarati Language and English Language (As per Appendix -B). | 100 | 3 Hours |

| 2 | Accountancy and Auditing, etc. (As per Appendix-B). | 100 | 3 Hours |

Note:

a) The standard of Gujarati Paper shall be equivalent to Gujarati subjects (Higher Level) of the

Twelfth standard of Gujarat Secondary and Higher Secondary Education Board.

b) The standard of English Paper shall be equivalent to English subjects (Higher Level) of Twelfth

standard of Gujarat Secondary and Higher Secondary.

c) The standard and the course content of the syllabus for Paper 2 (Accountancy and Auditing, etc.)

shall be of a degree level. The Scheme of the Paper shall be as prescribed in Appendix-B.

d) The details of the syllabus shall be as prescribed in Appendix-A and B.

e) The question papers for the main examination shall be of Descriptive type.

Preliminary Exam Syllabus:

| Sr. No. | Subject | Details of Syllabus | Marks to be allotted |

| 1 | General Studies | History of Gujarat, Geography of Gujarat, Environment, State and National Level Current Affairs, Indian Constitution, Science and Technology, Government Schemes, Disaster Management, Sports, Information and Communication Technology. | 20 |

| 2 | General Mental Ability | Logical Reasoning and Analytical Ability, Number Series, Coding Decoding, Problems based on clock, calendar and age, Square, Square root, Cube, Cube root, Power and exponent, H.C.F. L.C.F. Percentage, Simple and compound interest, Profit and loss, Time and work, Time and distance, Speed and distance, area and Perimeter of simple geometrical shapes. | 10 |

| 3 | ગુજરાતી વ્યાકરણ | સમાનાર્થી શબ્દો, વિરુદ્ધાર્થી શબ્દો, શબ્દસમુહ માટે એક શબ્દ, જોડણીશુદ્ધિ, ભાષાશુદ્ધિ (પદક્રમ, પદ સંવાદ), સંધિ જોડો અથવા છોડો, વિરામચિહ્નો, છંદ અને તેના પ્રકાર, અલંકાર અને તેના પ્રકાર, રૂઢિપ્રયોગો અને કહેવતો.. | 10 |

| 4 | English Grammar | Parts of speech, tenses, modal auxiliaries, articles, change the voice, direct and indirect speech, rearrange the jumbled words into a meaningful sentence, synonyms & antonyms. | 10 |

| 5 | Statistics and Mathematics | Data collection and analysis, measures of central tendency and measures of dispersion, sampling and methods of sampling, probability, index numbers, correlation, constant correlation, regression time series, statistical quality control, function, continuity, limit, Derivatives, permutation and combination. | 10 |

| 6 | Economics and Financial Administration | Introduction to economics, demand, supply and its relative value, concepts of income and expenditure, national income, inflation, economic reform policies, finance commission, capital disinvestment: monetary and fiscal policies, public debt, budget types and form, budgetary process, public accounts and audit, budget as a political instrument, the role of the Comptroller and Auditor General (CAG), NITI Aayog. | 10 |

| 7 | Management and International Business | Nature and importance of management, principles of management, functions of management, motivation and leadership; Introduction to international | 10 |

| business, promoting factors, advantages and limitations; Foreign exchange, Balance of payments and methods to correct disequilibrium, India’s Foreign Trade Policy; International Organizations: WTO, World Bank, IMF, IFC, IDA, ADB. | |||

| 8 | Public Administration | Public Administration – Introduction, organizational approaches and principles, organizational structure, administrative behavior, personnel administration, financial administration, coordination, delegation and supervision, control over public administration, performance studies, civil service performance and administrative reform. | 10 |

| 9 | Financial Accounting | Basic accounting concepts, principles- assumptions, types of accounts and their rules, process of accounts, trial balance, final accounts, rectification of errors and bank reconciliation statement, partnership accounts – admission, retirement, death and dissolution, Company’s accounts, financial statements, issue and forfeiture of shares, accounts of underwriting commission and valuation of goodwill and shares as per Companies Act, 2013. Indian Accounting Standards (Ind AS). | 10 |

| 10 | Income Tax Act and Goods and Services Tax (GST) | Basic concepts, tax incidence, Definitions in Income Tax Act, 1961, exempted Incomes, Residential Status, Computation of Taxable Income under various Heads, Deductions and Reliefs, Computation of Taxable Income of Individuals and Firms, Deductions of Tax, Filing of Returns, Different Types of Assessment, defaults and penalties, tax planning, tax evasion and tax avoidance, GST concept and GST laws. | 10 |

| 11 | Cost and Management Accounting | Cost Accounting: Concept of Cost, Types of Cost, Classification of Cost, Cost Centres, Cost Accounting and Cost Ascertainment; Fixed, variable and Semi-variable Cost, Direct Material, Direct Labour, Direct expenses, Overhead Costs, Prime Cost, Factory Cost, Production cost, Sales cost; Stock sheet, Different methods of Costing: Unit Costing, Process Costing, Batch and job Costing, Service Costing. Managements Accounting: Methods of financial statement analysis, marginal cost and break-even analysis, decision making, proportional cost, budgetary control, types of budget, cash budget, flexible budget and zero-base budgeting. | 10 |

| 12 | Accounting and Finance Computer Applications | Accounting and Finance Computer Applications – Tally. | 10 |

| 13 | Auditing – 1 | Meaning and Basic Elements of Auditing, Features, Objectives, Types, Advantages, Internal Control, Statutory Auditor: Appointments, Qualifications, Rights and Duties: Vouching – Meaning and objectives, types, and duties of the auditor regarding valuation of assets and liabilities. | 10 |

| 14 | Company Audit | Company audit and related provisions of Companies Act, 2013, auditor’s report and certificate, tax audit, duties of the auditor regarding profit distribution and depreciation, investigation, audit programme. | 10 |

| Total marks | 150 |

GSSSB Recruitment 2024 – How to Apply ?:

- Interested Candidates may Apply Online Through the official Website.

Job Advertisement: Click Here

Official website: Click Here

Apply Online: Click Here

GSSSB Recruitment 2024 – Important Dates:

The eligible graduate candidates willing to apply for GSSSB Accountant and Sub Accountant Recruitment must submit their application forms for which the link was activated on 23rd December 2024. The GSSSB Accountant and Sub Accountant Apply Online link and fee payment portal will be live till 01-03-2024, 11:59 pm. The complete schedule for GSSSB Accountant and Sub Accountant Recruitment 2024 has been discussed below.

| Event | Date |

|---|---|

| Apply Start | 15-02-2024, 02:00 pm |

| Last Date to Apply | 01-03-2024, 11:59 pm |

GSSSB Recruitment 2024 – Frequently Asked Questions (FAQs)

How to apply for GSSSB Accountant and Sub Accountant Recruitment 2024?

Interested Candidates may Apply Online Through the official Website.

What is the last date to apply for GSSSB Accountant and Sub Accountant Recruitment 2024?

01-03-2024, 11:59 pm

Stay connected with www.marugujarat.in for latest updates

Important Notice: Please always Check and Confirm the above details with the official website and Advertisement / Notification.

આ પણ વાંચો : 💥

Call Letters

Latest Results

Question Papers/Answer key